Does Civil Service Workers Have To Go On Medicare At 65;

Sarah O'Brien

Th, February 20th, 2020

CNBC

If yous're counting on working past your 65th birthday, be sure to consider how Medicare may factor into your plans — fifty-fifty if you already accept health insurance through your job.

While workers at companies with fewer than 20 workers mostly must sign up for Medicare at age 65, people working for larger companies typically have choices: They can stick with their group plan and delay Medicare without facing penalties down the road, drop the company option in favor of Medicare or go with a combination of the 2.

"The communication I give is to calculate the fiscal bear on for each option," said Elizabeth Gavino, founder of Lewin & Gavino in New York and an independent broker and full general agent for Medicare plans. "Effigy out your cost based on your usage and your medication, and do a comparison on what your outlay may be."

The share of people ages 65 to 74 in the workforce has been steadily rise for years. It's projected to attain thirty.two% in 2026, up from 26.8% in 2016 and 17.5% in 1996, according to the Agency of Labor Statistics.

And amid those historic period 75 and older, the trend has been the same: The share projected to exist working in 2026 is 10.8%, upward from 8.4% in 2016 and iv.6% in 1996.

Here are the Medicare rules that apply to would-be beneficiaries who are nonetheless working, forth with costs to consider.

Start, the basics

Original, or basic, Medicare consists of Part A (hospital coverage) and Function B (outpatient and medicare equipment coverage).

You go a seven-month window to sign upwardly, starting three months before your 65th altogether month and ending 3 months afterwards it. If you don't sign up when eligible and you don't meet an exception, you lot face belatedly-enrollment penalties.

Having qualifying insurance — i.e., a group plan through a large employer — is one of those exceptions.

Many people sign upwardly for Part A fifty-fifty if they stay on their employer's plan. That'southward considering it'due south free as long as you have at least a ten-year work history of contributing to the program through payroll taxes.

However, if y'all happen to have a health savings account paired with a high-deductible health plan through your employer, be aware that you lot cannot brand contributions one time you enroll in Medicare, even if only Part A.

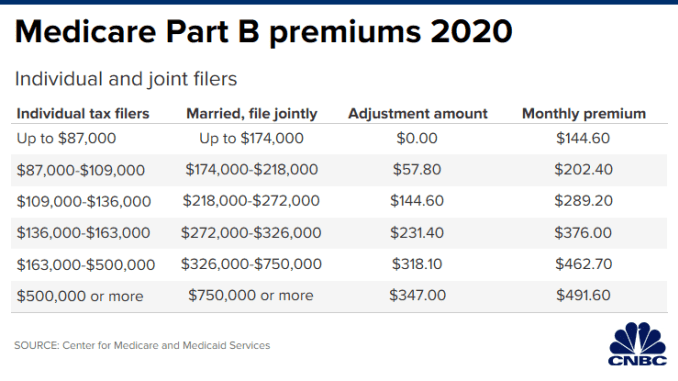

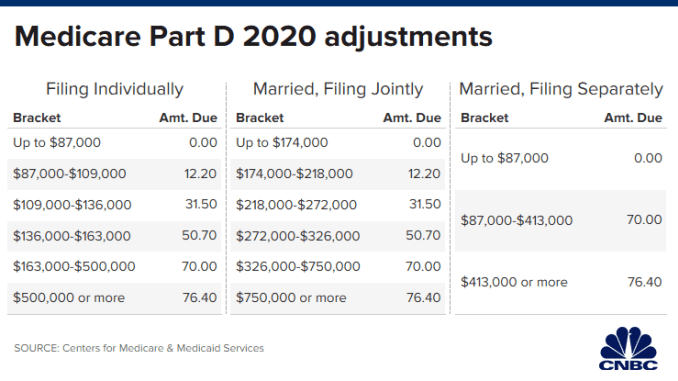

Office B comes with a standard monthly premium of $144.lx for 2020, although higher-income tax filers pay more through monthly adjustments (encounter chart above). Stand up-alone Office D prescription drug plans have monthly premiums averaging $30. And again, higher-income beneficiaries pay more than (encounter chart beneath).

Additionally, those adjustments are based on your income from two years earlier. In other words, your 2018 income is used for your 2020 premiums. (At that place's a grade you tin make full out to request a reduction in that income-related corporeality due to a life-irresolute event, such equally retirement.)

Roughly a third of Medicare recipients choose to get their Parts A and B delivered through an Reward Program. Those options typically include Function D prescription drug coverage, along with extras such as dental and vision. Yet, they also might accuse a premium, which would be in addition to your Office B premium.

Other people stick with basic Medicare and pair it with a stand-alone Function D plan. Some too add a Medicare supplemental policy — a.thousand.a., Medigap — which covers Medicare costs such as copays and co-insurance that you lot'd otherwise pay out of pocket. Even so, y'all cannot have both an Advantage plan and Medigap.

A 65-yr-quondam male volition pay anywhere from $126 to $464 monthly for a Medigap policy, according to the American Association for Medicare Supplement Insurance. For 65-year-old women, the range is $118 to $464.

And then when you're doing the math to compare your options, you'd accept to see what your best Medicare option would be and the cost of that coverage — using some assumptions about your employ of the health-care system and the toll of your prescription drugs.

If you lot work for a big company

The general dominion for workers at companies with at least xx employees is that you can filibuster signing upwardly for Medicare until you lose your group insurance (i.east., you retire). At that betoken, yous'd be subject to various deadlines to sign up or else confront late-enrollment penalties.

While everyone's situation is different, there's a adept chance your current insurance through piece of work is a more cost-constructive option, said Danielle Roberts, co-founder of insurance firm Boomer Benefits in Fort Worth, Texas.

This may exist due to lower premiums and other cost-sharing aspects such every bit copays or co-insurance, or lower costs for prescriptions nether the grouping plan.

"We ofttimes detect that their insurance is already quite practiced and information technology doesn't brand sense to leave it," Roberts said.

Once more, however, if Function A is complimentary, you can sign upwards equally long as it wouldn't interfere with your plans to contribute to a wellness savings business relationship.

Also, if y'all stay with your current coverage and filibuster all or parts of Medicare, make sure the plan is considered "creditable" coverage for both Parts B and D. Your insurance company should provide you with that information.

In that location are, of course, instances where Medicare might exist the meliorate option.

"If you lot're going to, say, therapy every week and it's a $xl co-pay, information technology might be cheaper to continue Medicare and become a supplement with it," Gavino said.

On the other manus, if yous take a specialty drug that is covered past your grouping plan, it might be wise to continue with it if that drug would be more expensive nether Medicare.

Some 65-year-olds with younger spouses also might want to go on their group plan. Unlike your company's option, your spouse must qualify on their own for Medicare — either by reaching historic period 65 or having a disability if younger than that — regardless of your own eligibility.

At pocket-sized businesses

For older workers with health insurance through a small company (nether 20 employees), you must sign up for Medicare regardless of whether you stay on that program or not. If yous do choose to remain on your employer's program, Medicare is your primary insurance.

Notwithstanding, Roberts said, information technology often is more cost-effective in this situation to drop the employer coverage and pick upwardly Medigap and a Office D programme — or, alternatively, an Advantage Programme — instead of keeping the piece of work plan every bit secondary insurance.

Often, workers at small companies pay more in premiums than employees at larger firms.

The average premium for single coverage through employer-sponsored health insurance is $7,188, according to the Kaiser Family Foundation. Still, employees contribute an average of $i,242 — or well-nigh 17.3% — with their company roofing the residue.

At small firms, the employee's share might exist far college. For case, 35% are in a plan that requires them to contribute more than than half of the premium for family unit coverage, compared with 6% of covered workers at large firms.

Does Civil Service Workers Have To Go On Medicare At 65;,

Source: https://chroniccarealliance.org/if-youll-still-be-working-at-age-65-heres-how-to-handle-medicare/

Posted by: arnoldforthemight.blogspot.com

0 Response to "Does Civil Service Workers Have To Go On Medicare At 65;"

Post a Comment