How To Check Broker Credit Score

Credit Score Monitoring and Privacy Tools

√ Credit Score Tracker

√ Credit Score Simulator

√ Credit Reports and Scores

√ Identity Theft Protection

It'south vital to check your credit score is in a expert shape, specially when you plan to utilize for a credit card, loan, etc. To notice out your real credit score, you need to asking your credit report. A penny saved is a penny earned, thankfully at that place are ways to check credit scores and credit reports for gratis. Read on for details.

How to check my credit scores

Information technology'south normal to see you lot have more than 1 credit score and each of them is slightly different. Credit scores are calculated based on your credit reports, so if you spot your credit score drib, check your credit reports immediately.

one. Go to creditscore.com

Creditscore.com is part of Experian, you can get your Fico score and Experian credit report for free one time a month. No credit bill of fare is required.

two. Check your credit card companies

Practise you have a credit card? Many major credit card companies and some auto loan companies (Banking company of America, Discover, Citi, American Express, etc.) provide a monthly Fico score for free with your business relationship. Some popular lenders similar Chase and Capital One provide credit scores, but not Fico scores. Exist conscientious if you lot demand a Fico score.

The score is usually listed on your monthly argument or tin exist plant by logging in to your account online.

iii. Use credit score services

WalletHub or CreditKarma are pop sites to get credit scores for costless. But they give a different scoring model. CreditKarma uses Vantage scores that are non used by the majority of credit card companies.

4. Pay for MyFico

Fico Score 8 is very popular and widely used by many lenders. If you're willing to pay for your credit scores, there are sites out there similar myfico that will allow y'all to purchase them. In that location for example you lot tin can buy all of your Fico scores, 30-something of them at this time for $29.

5. Apply a credit score monitoring service

IdentityForce offers credit reports and scores from Equifax, Experian, and TransUnion. IdentityForce tracks your single-bureau credit score monthly, this allows you to run into how and why your credit score changes. With this powerful tool, you can check your credit reports regularly to look for mistakes and early detect fraudulent activity to minimize the damage caused past identity theft.

Or endeavour IdentityIQ's Secure Pro. It provides annual credit reports and scores from all three bureaus. You'll have 3-Bureau credit report monitoring, $1 Million stolen funds Reimbursement, alerts on crimes committed in your name, score change alerts, and more than.

Practice credit checks affect credit scores?

Earlier checking for your credit written report for gratuitous, some people worry checking credit scores would bear upon their credit.

In short, soft credit inquiry (too known as "soft pull" or "soft credit checks") won't touch on your credit scores. And checking your own credit scores is reported as a soft credit bank check. You can check your credit scores as often as you want. In fact, regularly checking your credit reports and credit scores is an of import way to ensure your personal and financial information is accurate and it also helps to make sure nobody'south opened fraudulent accounts in your name. Checking your credit reports regularly is a manner to detect signs of potential identity theft.

Tips: Soft credit checks are inquiries only visible to you if they were recorded on your report which depends on credit bureaus.

In contrast, a hard enquiry, or a "difficult pull," shows upwards on your credit report and can affect your credit score. A hard pull happens when you utilize for a new credit carte or a new loan. A creditor, lender, or company requests to review your credit report as office of the loan application process, and the request is recorded on your credit report as a hard inquiry that affects your credit score.

Check your credit report for free easily

There are three credit bureaus (Experian, Equifax, TransUnion) that concur the credit reports. They allow you to bank check your credit report for free one time a yr.

Which i to choose?

If y'all're applying for a credit card or a loan and y'all know which credit reference agency the issuing banking company would use, plainly cheque that 1. For yearly checks, you can check all three credit reports. They have unlike content and all accept an bear upon.

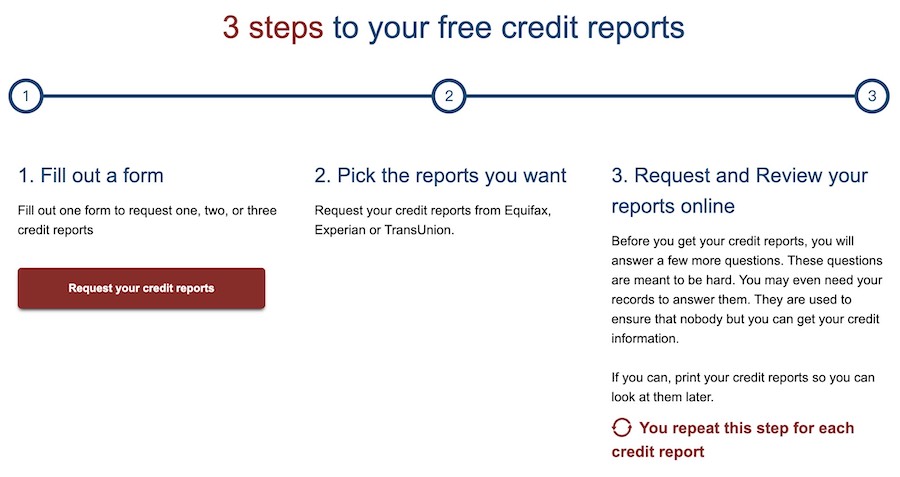

How to check credit reports for free easily

Of course, you can go to the three bureaus' official websites to utilise for your credit reports. But you lot tin asking your free credit report from Equifax, Experian, and TransUnion on annualcreditreport which is the simply official site explicitly directed by Federal law.

You were allowed to receive a free credit report once a yr from AnnualCreditReport. Due to the COVID-19 pandemic, people are having a hard fourth dimension. AnnualCreditReport offers free weekly online credit reports to help you in control of your finances, the service volition finish on Dec 2023.

How to monitor your credit report

If your identity is at risk, you'll need a credit monitoring and financial fraud protection service.

Aureola'south credit written report monitoring will assist you stay on top of your credit. Protect your credit score by receiving alerts if suspicious activity is detected. Their credit protections are comprehensive, their identity monitoring is robust, and their bonus features – the malware protection and the VPN – put them head and shoulders above many other identity theft protection services we've reviewed then far.

Source: https://www.supereasy.com/how-to-check-credit-score-free/

0 Response to "How To Check Broker Credit Score"

Post a Comment